- Dapatkan link

- X

- Aplikasi Lainnya

With the 225 calls in February costing 13 a piece you may want to look at the 240 calls instead. Find a Symbol Search for Option Chain When autocomplete results are available use up and down arrows to review and enter to select.

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

Touch device users explore by touch or with swipe gestures.

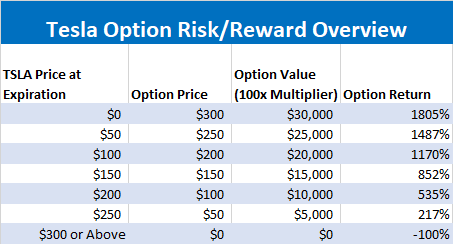

Tesla call options. Yours in Profit Gordon Lewis Options Trading Research. Best Tesla Call Options factors impacting exchange rates boundless finance bitcoin guru julian hosp forecast chatting with a bitcoin genius. Strike price bid ask volume open interest.

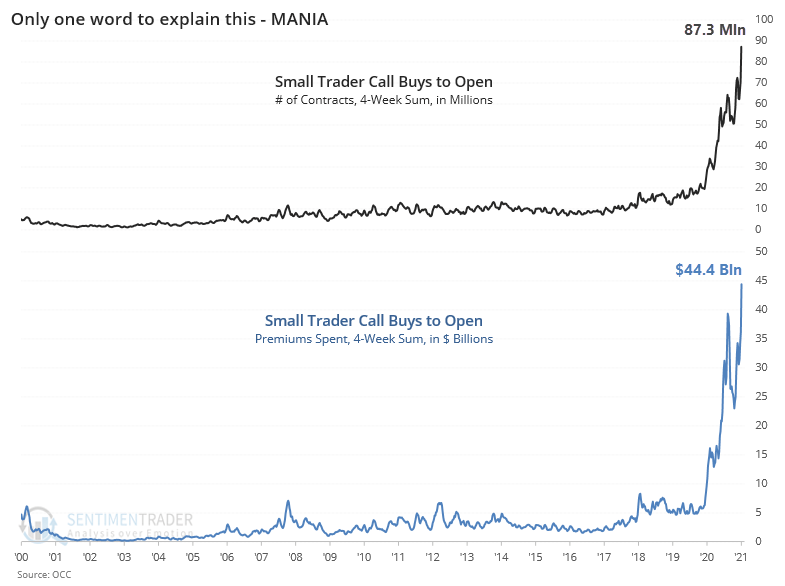

The call options give Pelosi the right to buy 2500 Tesla shares at US500 each at any point before they expire in March 2022. And right now its looking like investors are swarming Tesla call options to make a profit from the surge in the markets. Theyre about half the cost at around 7 and arent too far out of the money.

Robinhood is a great app thats lets you invest in stocks. Put-Call Ratio Open Interest. February 20 th expiration gives you about 50 days for the stock to move higher in your favor.

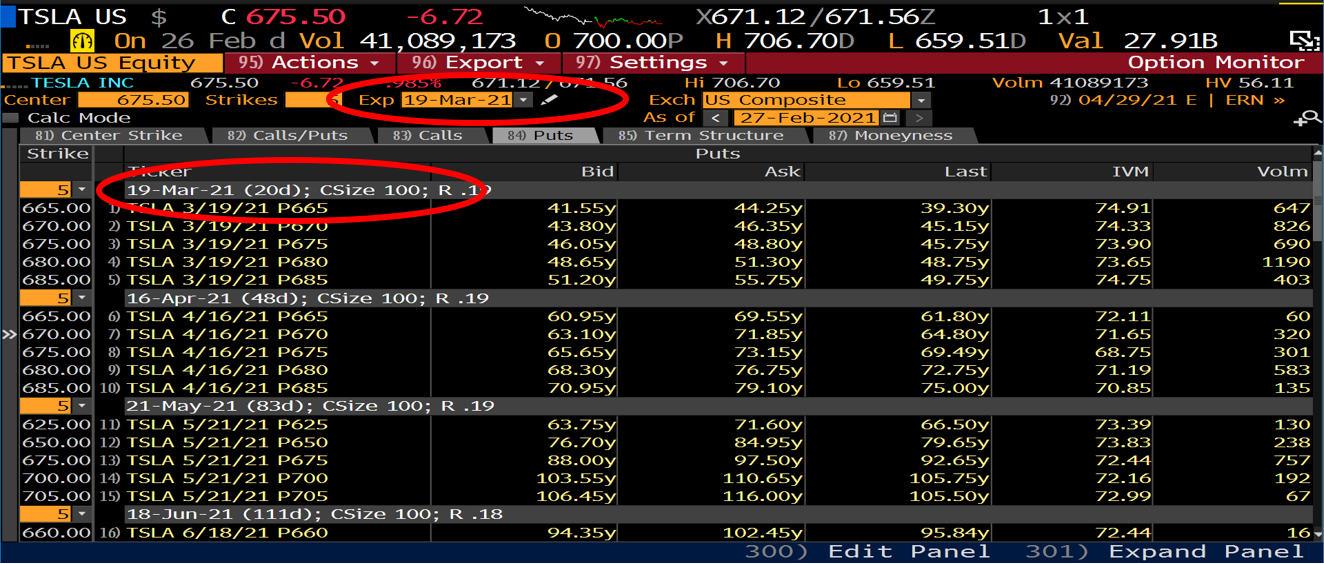

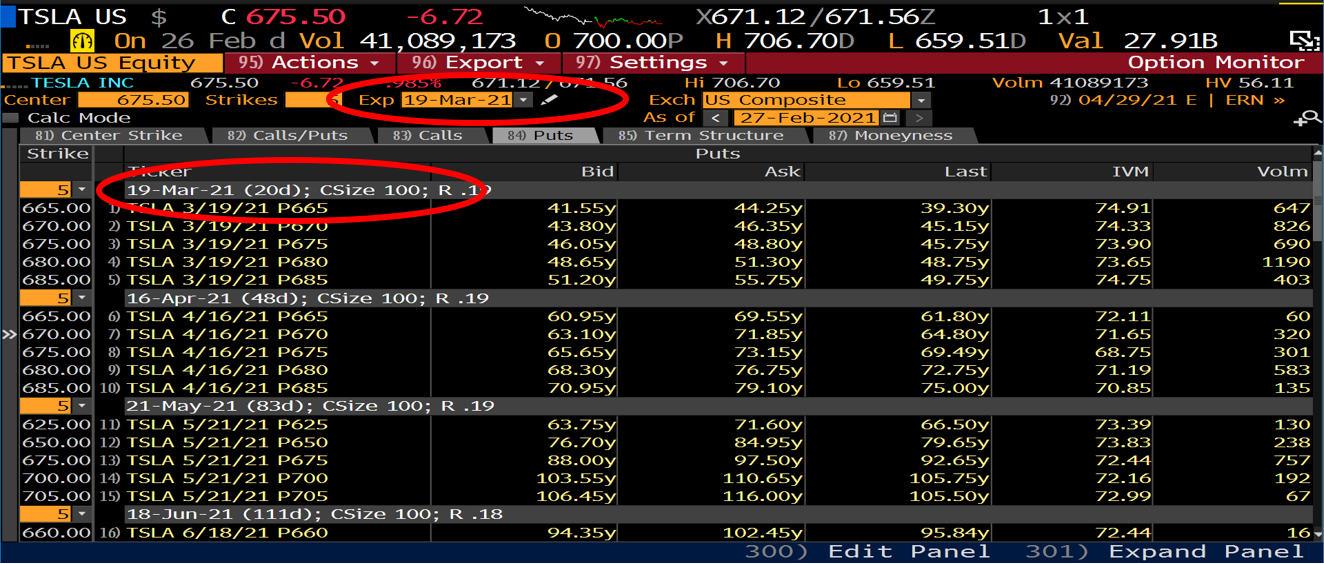

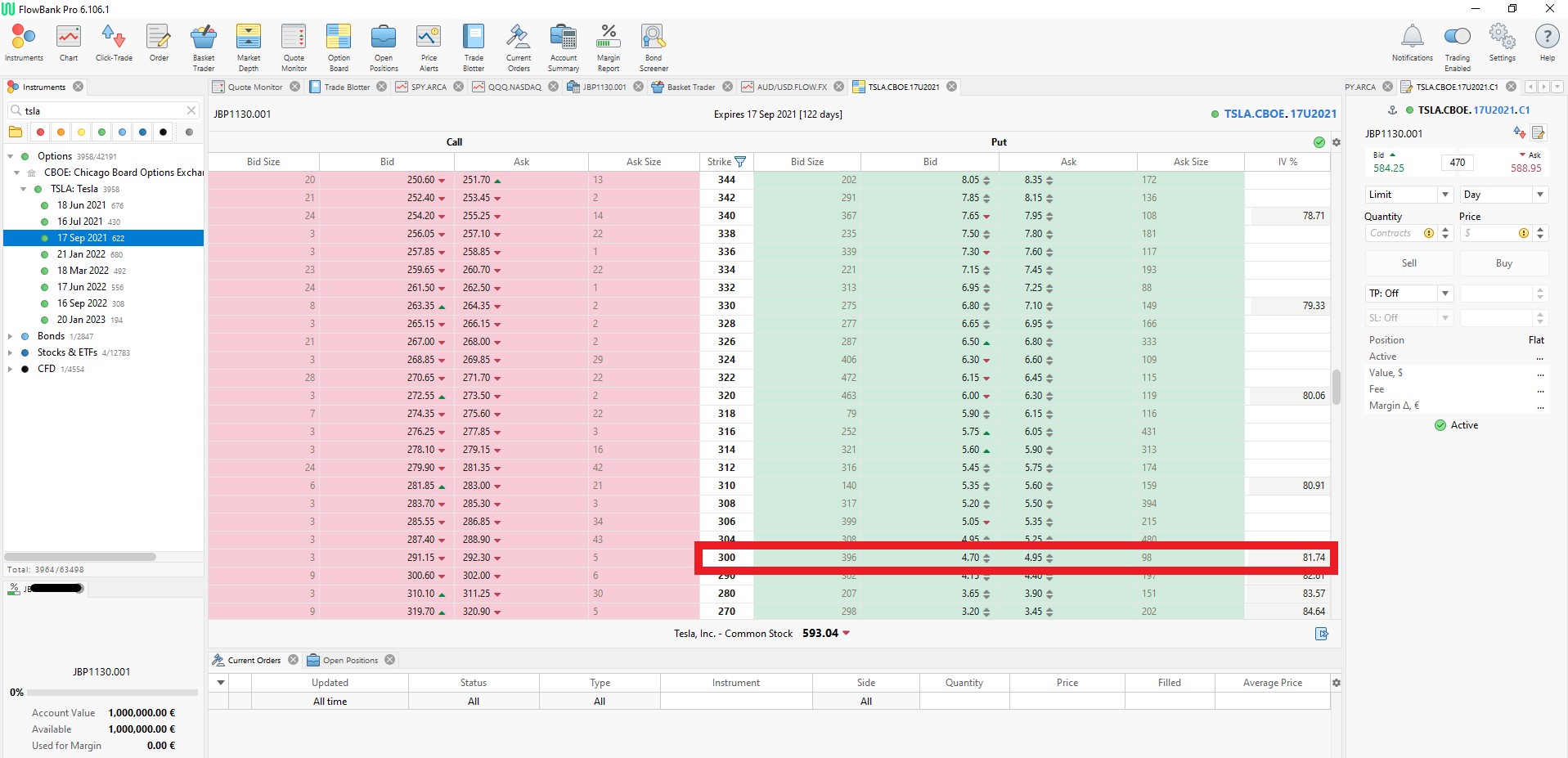

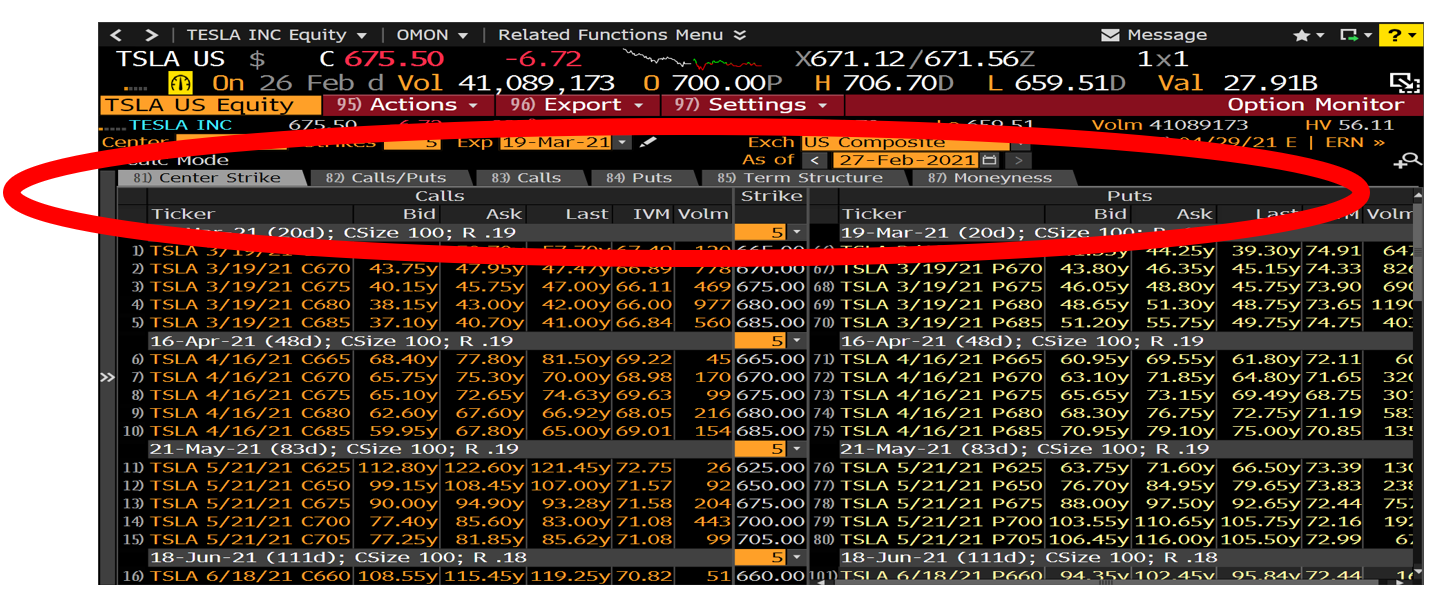

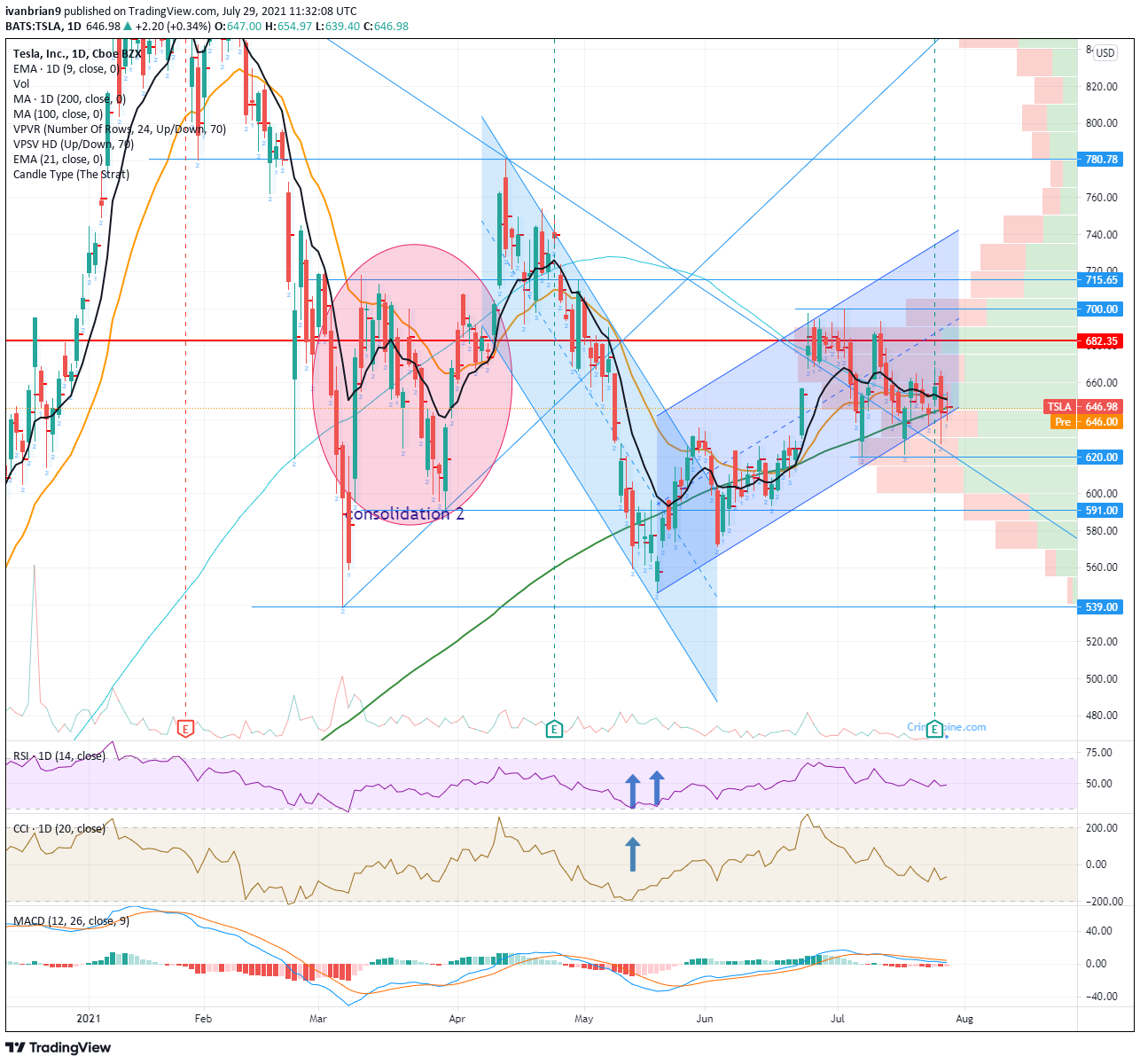

You can also view options in a Stacked or Side-by-Side view. TSLA had 30-Day Put-Call Ratio Open Interest of 06113 for 2021-07-13. Tesla shares soared to 700 on Monday.

Get Options quotes for Tesla Inc. Back to TSLA Overview Call and put options are quoted in a table called a chain sheet. The implied volatility of Tesla options currently averages 71.

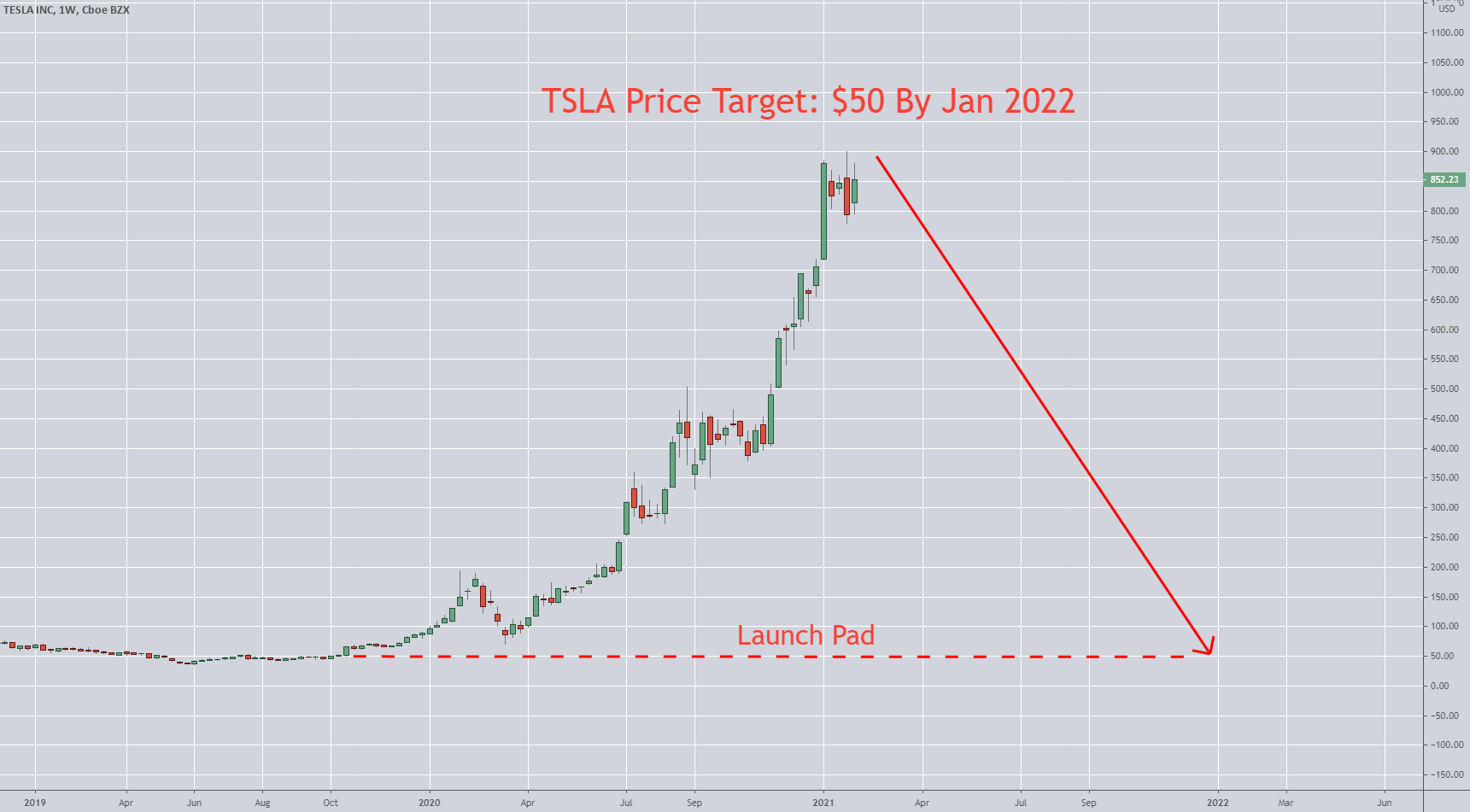

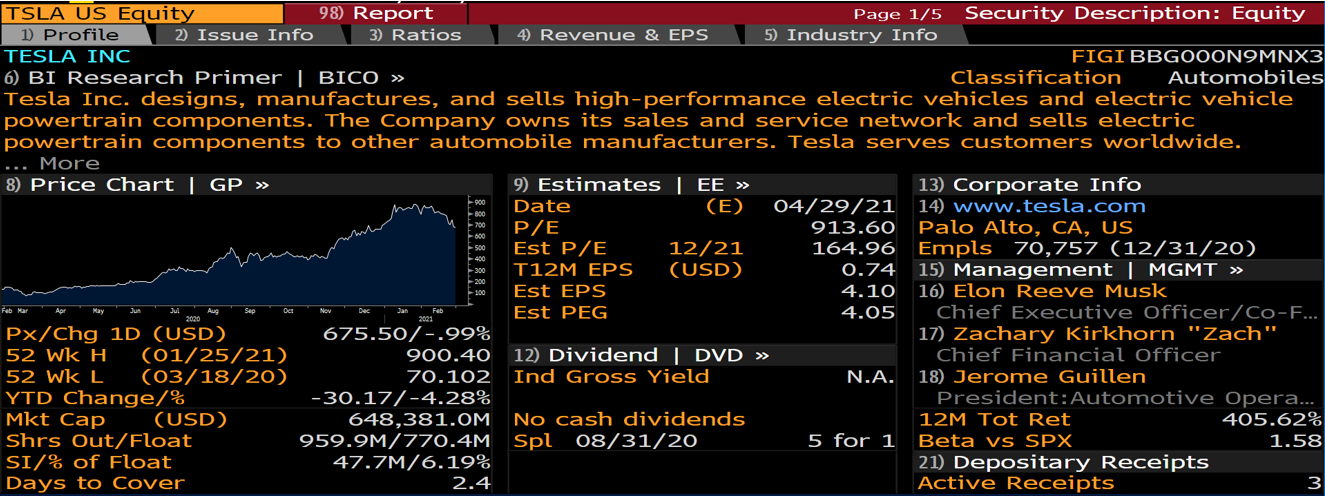

Tesla shares have risen from 64034 at the time the calls were purchased to over 890 today. TSLA is finally out of trading range. Now TSLA call options tend to be expensive but you still want to buy some time.

The View setting determines how Puts and Calls are listed on the page. Buy to Open the TSLA July 625 Calls for 46. However this trade has unlimited upside potential just like a stock purchase but at a fraction of the cost 4600 vs.

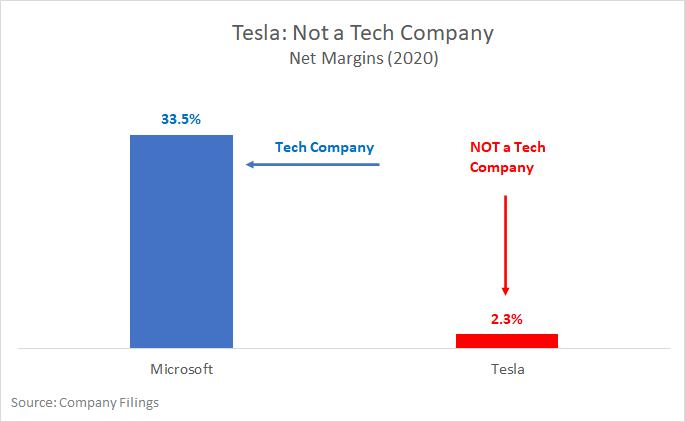

Just one year later and its now at more than 860. What are Tesla options. Interested in trading Tesla options.

Theta Annual columns means the yield on collateral on cash secured puts. There are two main types of Tesla options to trade. In this video I talk about a user on the popular subreddit wall street bets who currently has 20 ca.

The call options were valued at 112 million as of Monday. Select an options expiration date from the drop-down list at the top of the table and select Near-the-Money or Show All to view all options. Shares in the electric car giant will target the next resistance at 781.

Around this time last year TSLA traded at 130. For calls its yield on collateral on the share price 100 since the collateral is 100 shares. Option quotes with an asterisk after the strike price are restricted options typically created after spin-offs or mergers.

The chain sheet shows the price volume and open interest for each option strike price and expiration month. Traders thats a 700 gain. Or put simply most options are.

The options listed above have an implied volatility of 332 recently according to data from Yahoo. Tesla calls and Tesla puts. The purchases by.

Tesla options are a financial derivative which enable you to trade Tesla stock at a set price known as the strike price before a predetermined date known as the expiry. The ratio of outstanding put contracts to outstanding call contracts at the close of the trading day for options with the relevant expiration date. Tesla stock finally gave us something to write about on Monday and try our hand at trading when the stock broke through the 700 and.

10-Day 20-Day 30-Day 60-Day 90-Day 120-Day 150-Day 180-Day. 361 rows View the basic TSLA option chain and compare options of Tesla Inc. The most you can lose on this trade is 4600 per call purchased if Tesla stock were to close below 625 on July 16 2021.

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

Call Option Definition How To Use Examples

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

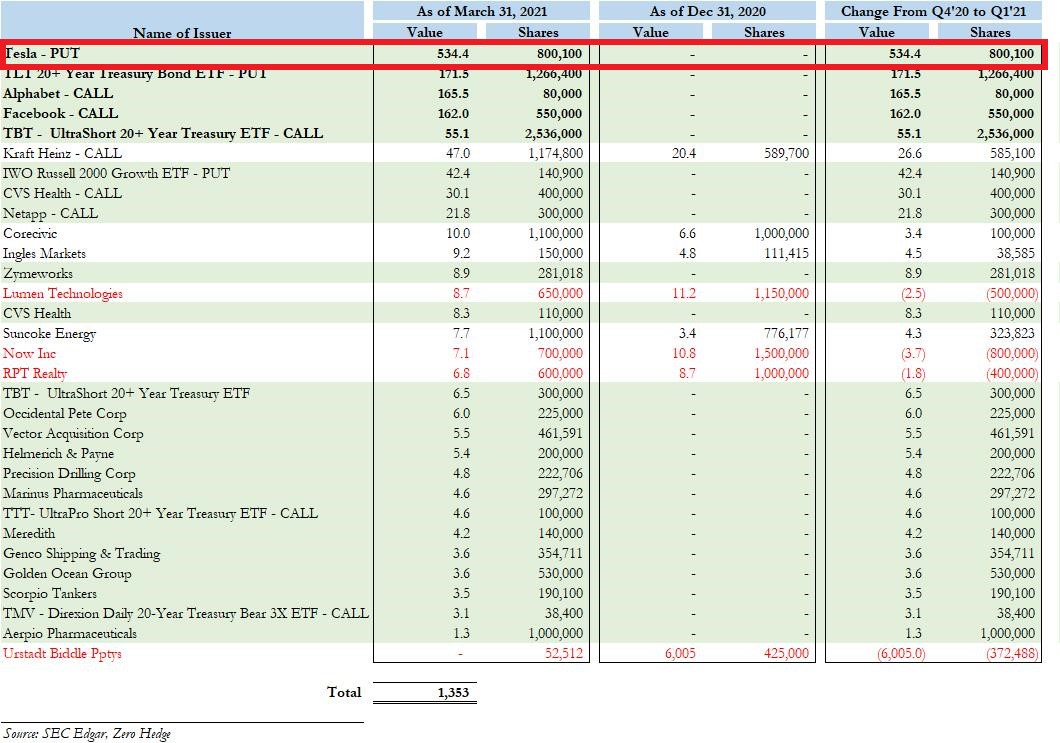

The Case Of 276 000 Put Options On Tesla With A Strike Of 20 By Diego Alvarez Nerd For Tech Medium

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

Beginner S Guide To Call Buying

The Case Of 276 000 Put Options On Tesla With A Strike Of 20 By Diego Alvarez Nerd For Tech Medium

460 To 1 Million With 4 Tesla Call Options Insane R Wallstreetbets Youtube

Why Tesla At 1 900 Is Free Money

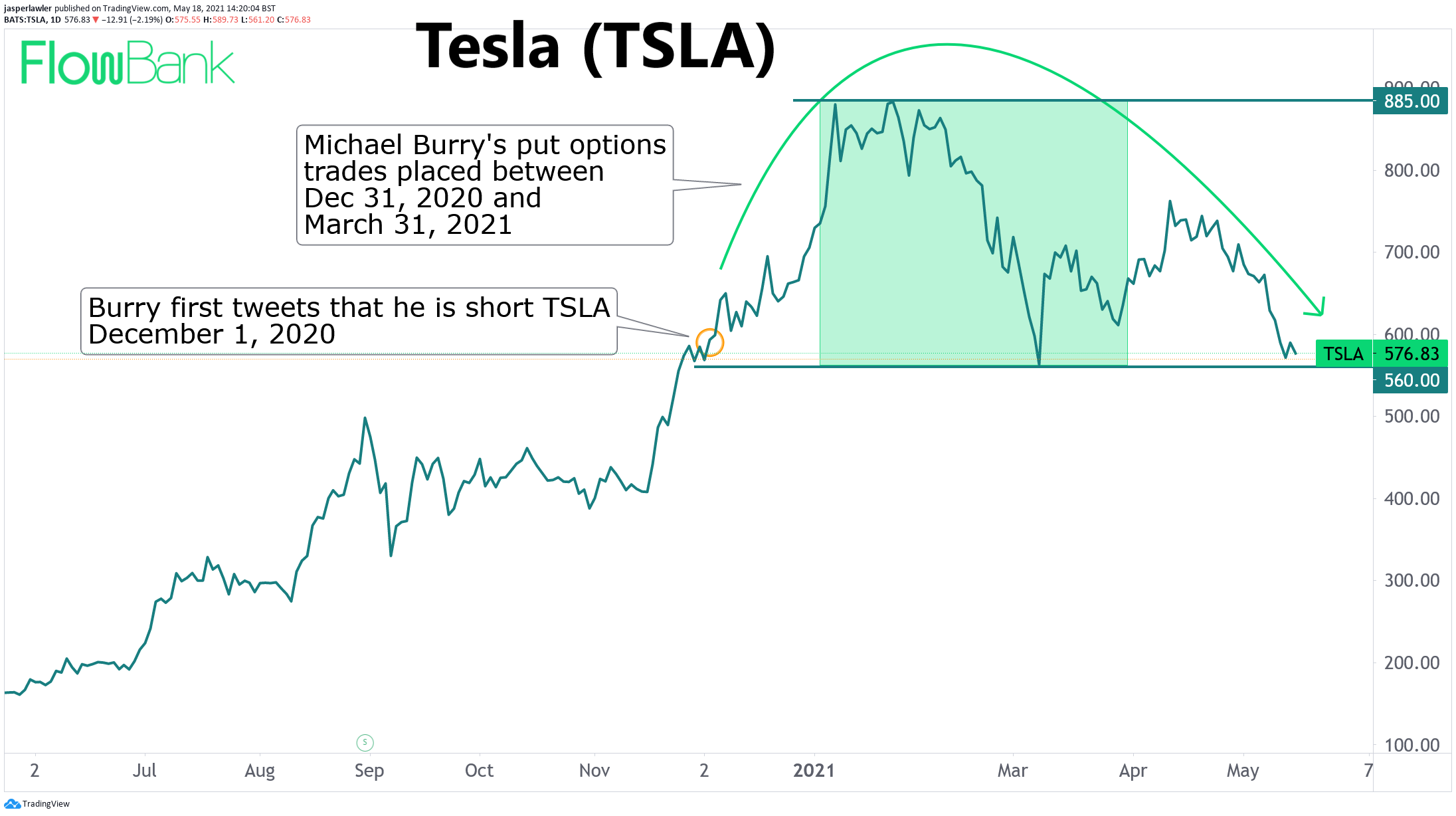

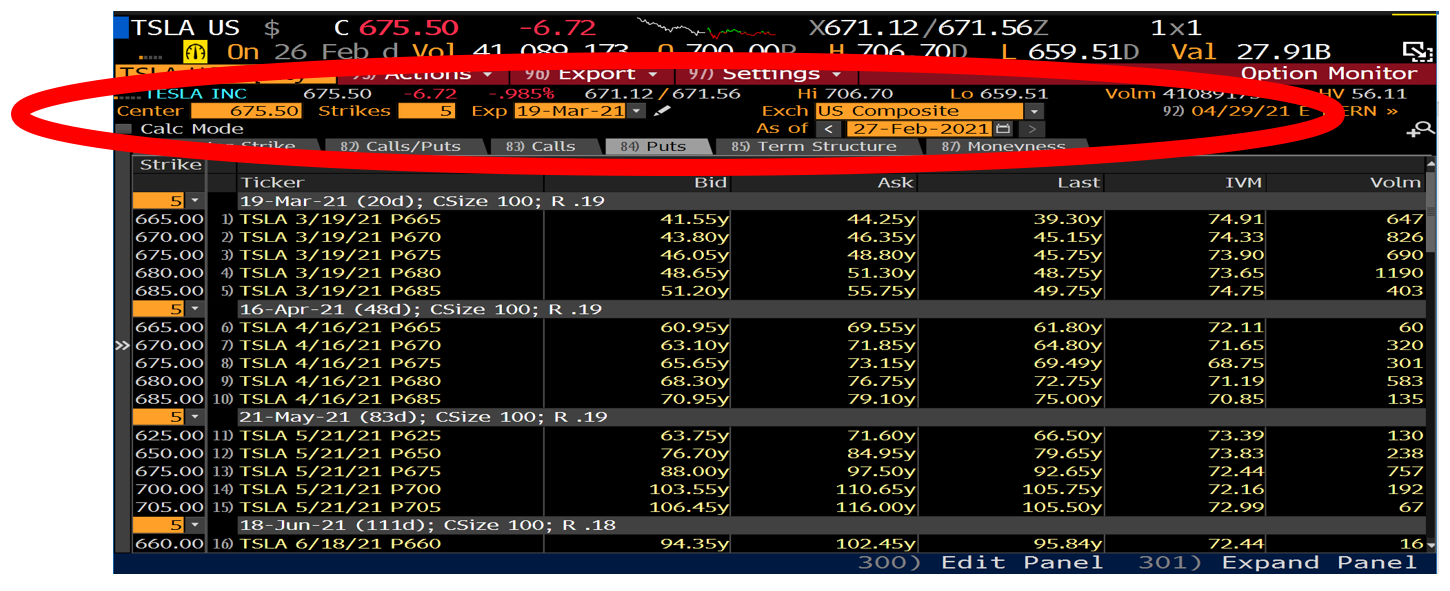

What Is A Put Option How Big Short Michael Burry Shorted Tesla

The Case Of 276 000 Put Options On Tesla With A Strike Of 20 By Diego Alvarez Nerd For Tech Medium

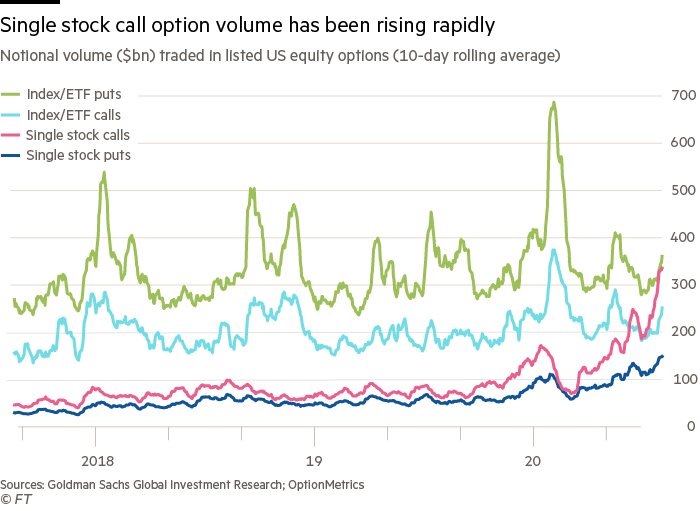

Softbank Unmasked As Nasdaq Whale That Stoked Tech Rally Financial Times

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

What Is A Put Option How Big Short Michael Burry Shorted Tesla

How Tesla Options Can Hedge Against A Market Meltdown Nasdaq Tsla Seeking Alpha

The Case Of 276 000 Put Options On Tesla With A Strike Of 20 By Diego Alvarez Nerd For Tech Medium

What Is A Put Option How Big Short Michael Burry Shorted Tesla

The Case Of 276 000 Put Options On Tesla With A Strike Of 20 By Diego Alvarez Nerd For Tech Medium

How To Find Out What Options A Tesla Has

Komentar

Posting Komentar